Bankman-Fried arrested in the Bahamas

14/12/2022

How not to pay taxes

10/04/2023The third key concept of any sales operation is independent, qualified assessment

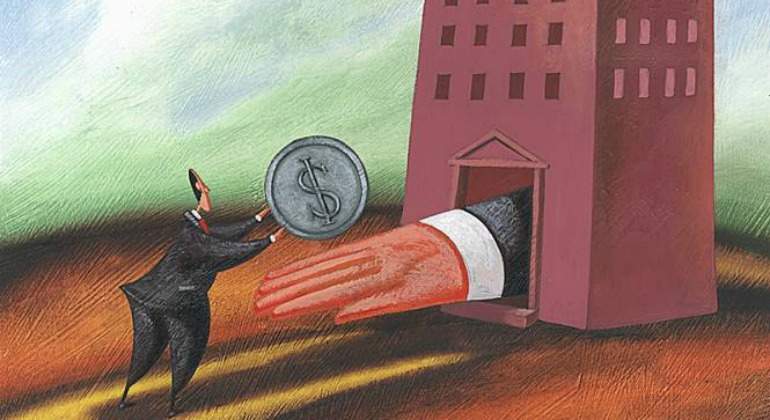

Is it not the duty of every seller to display the benefits of their product so that the buyer can find a solution for their needs? Once again, we have two of the three key concepts: product and need. My hypothesis: the financial system does not always sell the products that the client needs.

Last week, during the presentation of a Spanish bank’s financial results, the Chief Executive Officer answered the question as to why they did not recompense deposits by saying that the bank considers that there are other financial products which reward saving. For example, annuities. This can be explained in different ways. Guaranteeing heirs the sum of the investment in the event of death and recompensing the capital with monthly income. A deposit without liquidity and the charging of monthly interest. Or, technically, paying the risk premium with the client’s money and paying an immediate annuity income with the difference. In other words, the bank minimises risks as much as possible and exercises its lawful right to maximise its profits.

Expansión (a Spanish economic and business newspaper) has published its conclusions on the pension fund portfolios in the United States. Long gone are the times when portfolios used the classic formula of 60% stocks and 40% bonds. This has progressively diversified towards other types of assets, such as risk capital, the real estate sector or hedge funds. But these types of position are usually kept below 20% of the portfolio, as they are less liquid, although they have better perspectives of profitability in the long term. The fall in shares and bonds in 2022 led to an increase in the percentage of involvement of risk capital fund assets due to a purely arithmetical effect. It is estimated that there is a surplus of USD 30,000 million. In this case, fund managers will also be taking decisions about their asset allocation strategies.

In sales, in order to charge their customers, salespeople have to get buyers to buy the product. Otherwise, there is no income or payment because there has been no recompense for the sales work. The only way for the buyer to minimise risks is by hiring the services of an adviser or consultant. They can advise the client on the best product to solve their needs. The third key concept of any sales operation is independent, qualified assessment. If companies and individuals do not want to buy the products that the financial system considers to be suitable for their needs, then expert advice is a necessity so that they can find the products that they really need. Buying a car, buying clothes or buying financial products are not the same.

Jaume Quibus

The actuary and economist Jaume Quibus holds a master’s degree in Financial Economics and Accounting, a degree in Actuarial and Financial Sciences, a degree in Economic and Business Studies from the University of Barcelona and has completed the Management Development Programme at the IESE Business School of the University of Navarra. He is a full member of the following associations: the Catalan Actuarial Association, the Spanish Actuarial Association, the Catalan Economists Association, the International Actuarial Association, the Catalan Association of Accounting and Management and also a member of the IESE Business School Alumni. He was a founding partner in 1998 of the actuarial company Quibus, and is corporate member number 6 in the Catalan Actuarial Association.