Calculator and Simulator for Life and Term Annuities

Receive your personalized report by email in less than 60 seconds

Option 1: Calculation of the necessary capital for the desired monthly lifelong pension

🎯 Objective:

To know the necessary capital for the desired lifetime annuity based on age.

📝 What will you get?

A report containing the results of actuarial calculations related to the life annuity.

You can see an example of the report here.

Your calculation and your personalized report are 100% FREE

Example:

In example 1, Andrés is 65 years old and he is married with 2 children. He is worried about the future in terms of his retirement income and savings.

Andrés would like to ensure that he has a pension of 1,000€ a month.

Moreover, he thinks that the growth of his annual pension should be 1%, and the interest rate 3%.

As we can see in the result, Andrés will need to save a total of 231,367.36€ for the day he retires, in order to be able to buy a life annuity with these conditions.

0,00 €

Option 2: Calculation of the monthly pension received in return for the capital investment

🎯 Objective:

To obtain the monthly income that will be received in return for your capital investment.

📝 What will you get?

A report containing the results of actuarial calculations related to the life annuity.

You can see an example of the report here.

Your calculation and your personalized report are 100% FREE

Example:

In example 2, María is 65 years old, she is married and she has recently retired. She has savings and she would like to invest them in her retirement plan and receive a lifelong pension.

She currently has capital of 200,000€ that she can invest and she thinks that the income growth should be 2%, and the interest rate 3%.

As we can see in the result, by making an investment of 200,000€, María will be able to receive a lifelong pension of 673.28€ a month with an annual revaluation of 2% and an interest rate of 3%.

0,00 €

Option 3: Calculation of the necessary capital for the desired monthly term pension

🎯 Objective:

To know the necessary capital for the desired lifetime annuity based on age.

📝 What will you get?

A report containing the results of actuarial calculations related to the life annuity.

You can see an example of the report here.

Your calculation and your personalized report are 100% FREE

Example:

In example 1, Andrés is 65 years old and he is married with 2 children. He is worried about the future in terms of his retirement income and savings.

Andrés would like to ensure that he has a pension of 1,000€ a month for the next 10 years if he survives.

Moreover, he thinks that the growth of his annual pension should be 1%, and the interest rate 3%.

As we can see in the result, Andrés will need to save a total of 106,002.13€ for the day he retires, in order to be able to buy a life annuity with these conditions.

0,00 €

Option 4: Calculation of the monthly term pension received in return for the capital investment

🎯 Objective:

To obtain the monthly income that will be received in return for your capital investment.

📝 What will you get?

A report containing the results of actuarial calculations related to the life annuity.

You can see an example of the report here.

Your calculation and your personalized report are 100% FREE

Example:

In example 2, María is 65 years old, she is married and she has recently retired. She has savings and she would like to invest them in her retirement plan and receive a lifelong pension.

She currently has capital of 500,000€ that she can invest and wants to receive a temporary income for the next 8 years if she survives and she thinks that the income growth should be 2%, and the interest rate 3%.

As we can see in the result, by making an investment of 500,000€, María will be able to receive a term pension of 5,463.11€ a month.

0,00 €

For which cases is it worth obtaining this report?

The importance of annuities for the insurance industry

Guaranteed lifetime annuities are insurance products involving the payment of a lifelong pension until your death, in exactly the same way as the social security pension from the state.

Who is this calculator for?

This calculator is for anybody, regardless of their age, who wishes to know how much to save for their retirement or which pension they can buy at the age of 65. (If you are older than this, contact us).

What is the purpose of the calculator?

The purpose is to raise awareness among people who are interested in their retirement as to how much money they need to save in order to receive a guaranteed lifetime annuity when they retire or what their lifelong pension will be when they reach 65, with the savings they have.

Important concepts for this calculation

Pension revaluation

This value refers to the percentage of annual adjustment of the lifetime annuity income aimed at mitigating the effect of inflation. In other words, today’s 500€ will not have the same purchasing power in a few years’ time.

For example, if the value for the annual pension revaluation is 2% and your lifelong pension is 1,000€ a month, in the second year this would increase to 1,020€ a month, the following year to 1,040.20€ a month, and so on until the moment of death.

Interest

This refers to the interest on the annuity insurance product; at present, percentages are between 2% and 3%, depending on the insurance company.

The interest is the return on your savings.

We will work with the insurance company to obtain the best conditions for you without charging a commission.

The current situation is generating an annual interest rate for these insurance products of around 2% and 3%, a situation which has not occurred for quite a few years. Now may be a good moment to make this type of investment in guaranteed lifetime annuity products, as with the current interest rate you will obtain a higher pension with the same amount of savings or you will need to pay less for the same pension.

Sentences that support actuarial calculations

Sentence of the Supreme Court of Spain 117/2023, of 2 February 2023: This ruling addresses the interpretation of articles 1802 and subsequent articles of the Civil Code in relation to life annuity contracts. The Court analysed how the regime for these incomes should be calculated actuarially, considering factors such as life expectancy and financial conditions, similar to the existence of a pension fund.

Sentence of the Supreme Court of Spain 705/2020, of 23 July 2020: In this case, an immediate life annuity payment was under discussion. The insurance company guaranteed the payment to the beneficiary of a life annuity as long as this person lived. In order to establish the correct amount for the income, use was made of actuarial calculations that considered factors such as the beneficiary’s life expectancy and the financial conditions of the contract.

You are going to live a long time

It should be kept in mind that in many case, the interested person will make the calculation depending on their life expectancy or the length of time they think they will live.

With this data they will have a parameter to compare whether having a guaranteed lifetime annuity is better than managing their own money or capital.

The main problem is that this comparison does not consider the possibility of living many more years than expected.

It should be remembered that life expectancy is increasing, that is to say, we live for more years on average (although it may seem like the opposite).

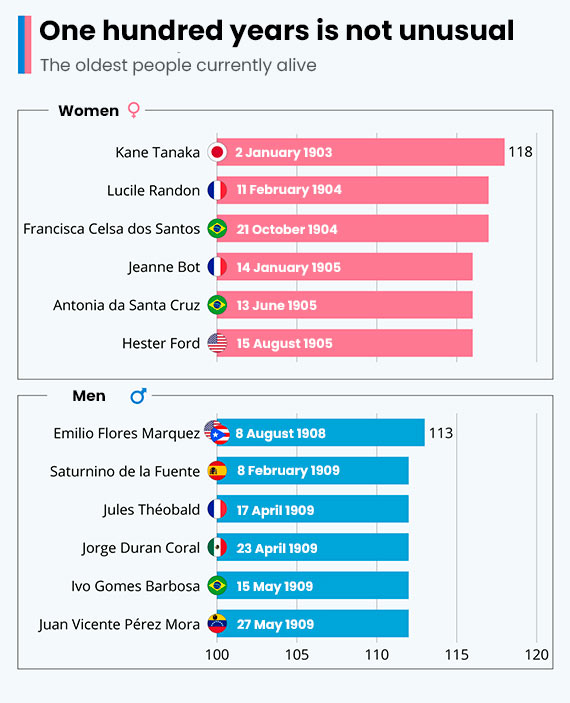

Here are some real examples, by way of reference:

To continue with example 2, María, who holds capital of 200,000€. If she managed her own money instead of investing in an insurance product, the result would be as follows:

With this capital, María would have 695€ a month with an annual revaluation of 2% for 18 years, 9 months and 15 days.

In other words, from the age of 83 years, 9 months and 15 days she would no longer have any savings.

If she dies before this, she would not have any problems if she manages the money herself. However, in the event of María dying at 100 years old, for the last 16 years and 3 months of her life she would have no savings.

Nevertheless, with the guaranteed lifetime annuity María ensures that she will have a monthly pension regardless of her age at the time of death.