Calculation of compensation for collective dismissals

Who is the calculation of compensation aimed at?

The calculation of severance pay for collective dismissals is mainly aimed at companies and their human resources managers. We provide comprehensive support to help manage this compensation appropriately and accurately, whilst ensuring compliance with all current legal regulations.

Above and beyond calculations

Our work does not only focus on numerical calculations; it also includes the interpretation of labour laws to ensure that compensation practices are in line with the most recent jurisprudence and legislation. This is crucial to minimise the legal and financial risks, as well as other risks associated with collective redundancy processes.

Key concepts in the calculation of compensation for collective dismissals

Base Salary

This is a fundamental concept, as it is the basis for calculating compensation. It includes the employee’s total earned income, whether in money or in kind. In order to calculate the base salary correctly, it is necessary to consider all the salary components, including salary bonuses, benefits and any other payment received, prorated according to applicable legislation. Jurisprudence plays an essential role in defining the elements to be included in this calculation.

Employee Tenure

The employee’s length of service in the company also plays a vital role in compensation calculations. Severance pay is determined according to the time that the employee has worked for the company, with a specific amount allocated for year of service. This calculation may vary depending on the specific applicable legislation and the details in the work contract. In some cases, periods of under a year are prorated by months.

Cause of Dismissal

The reason for dismissal has a significant effect on the amount of severance pay. For example, unfair dismissal (without suitable justification according to the law) generally involves greater compensation than a fair dismissal (for reasons that are economic, technical, organisational or to do with production). Each cause for dismissal has specific rules that determine how severance pay should be calculated, including differences in the calculation formulas and the maximum caps that can be applied.

We advise the company on all the stages of termination of employment

Strategic consultancy

We provide comprehensive advice on dismissals, from the initial evaluation to the employee’s retirement, aligning the process with the company’s strategy and considering the economic, legal and social implications.

Analysis of the workforce

Assessment of collective dismissals in accordance with the criteria established by the Spanish General Council of the Judiciary and current labour laws.

Communication and dialogue

We help the company with the preparation of formal and informative notifications and with the facilitation of dialogue sessions with employees and trade unions to ensure clear and respectful communication.

Support

The employee is supported up to the beginning of receiving payment for their retirement.

We ensure that all of our calculations and procedures follow the guidelines strictly, in accordance with the criteria established by the Spanish General Council of the Judiciary and current labour laws. This involves adaptation to changes in legislation and the inclusion of relevant precedents that affect the interpretation and application of regulations concerning severance pay.

If you would like to receive our calculations for compensation, do not hesitate to contact us, we will be delighted to provide them.

How to receive the calculations for compensation?

Provide the employee data

So that we can carry out an exact calculation of the cost of severance pay, we need the following employee data:

- Date of birth

- Age

- Seniority date

- Years of service

- Gender

- Children under the age of 26

- Marital status

- Gross annual salary

- Withholdings and deductions (personal income tax/social security)

- Net annual salary

- The last 12 months of the contribution base for unemployment benefit

We will provide you with a template to fill in with the details so that we can process all the information.

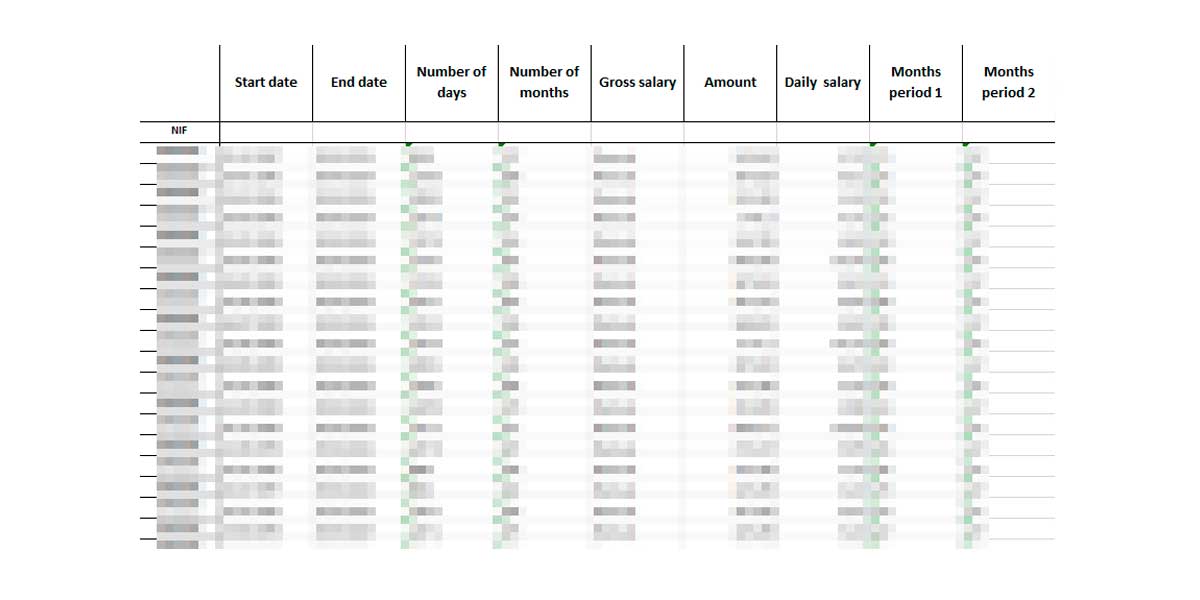

We carry out the compensation calculations

We carry out the calculations for each type of dismissal:

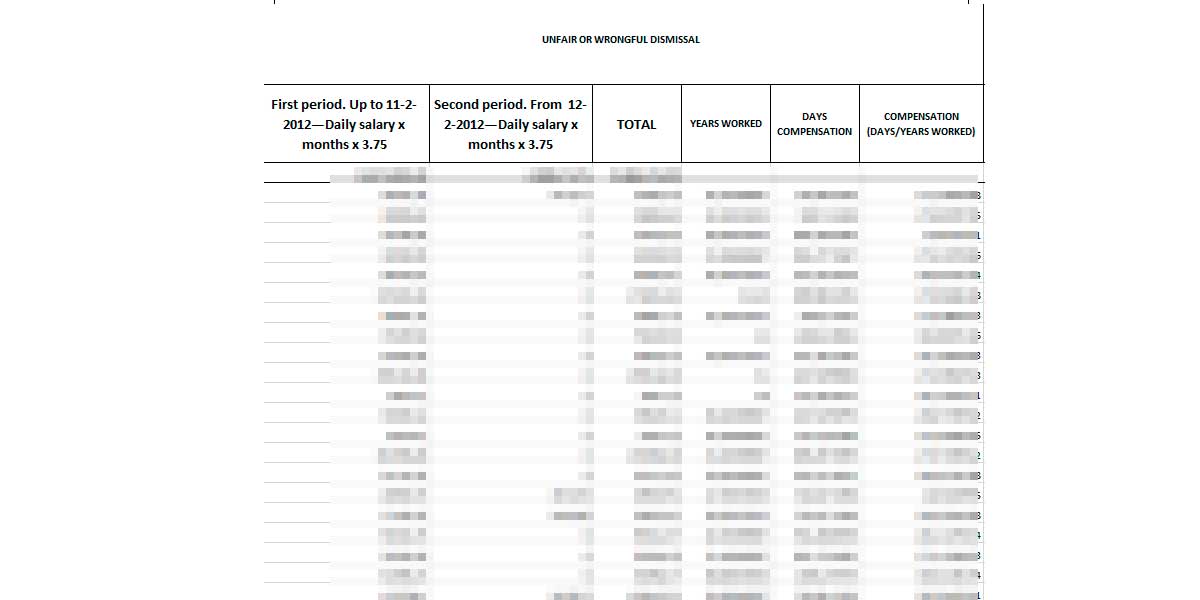

- Unfair or wrongful dismissal

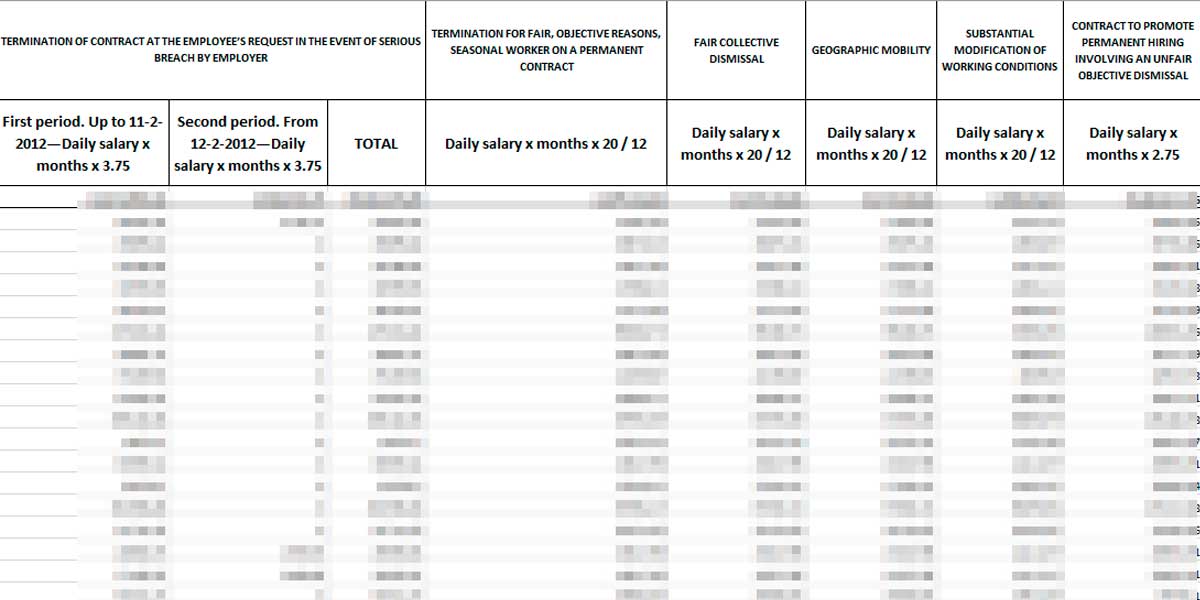

- Termination of the contract by the employee (constructive dismissal) in the event of a serious breach by the employer

- Termination for fair, objective reasons and involving a seasonal worker on a permanent contract

- Fair collective dismissal

- Geographic mobility

- Substantial modification of working conditions

- Contract to promote permanent hiring involving an unfair objective dismissal

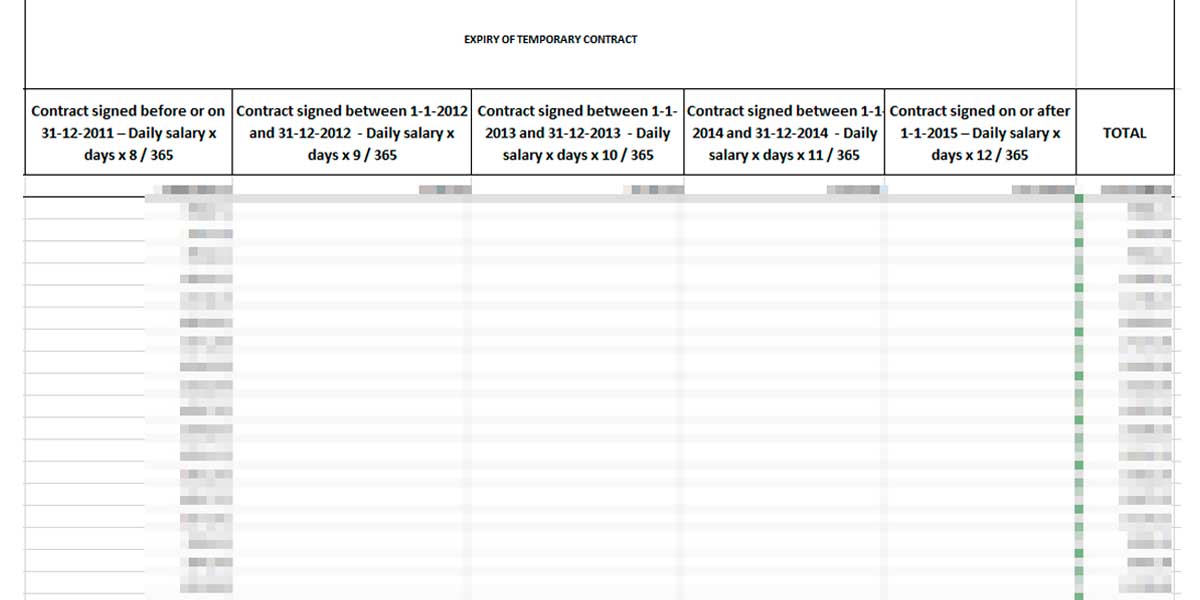

- Expiry of a temporary contract

Receiving the results

The results of our calculations are presented in a detailed report that not only shows the figures for compensation but also includes exhaustive analyses. This report highlights the financial and legal implications in each case, providing a solid basis for informed decision-taking. Furthermore, we make strategic recommendations to handle future situations involving dismissal in a more efficient way in accordance with the law.

Alternative solutions to severance pay for collective dismissals

Faced with the need to carry out collective dismissals, companies may explore alternative solutions to traditional compensation packages, such as income schemes.

These schemes offer a long-term form of compensation, by providing the dismissed employees with an income up to the date of their retirement and enabling companies to spread costs over time instead of making one single payment.

This long-term payment structure can improve the company’s liquidity and financial stability, by avoiding large payouts that could affect its effectiveness.

Additionally, the introduction of income schemes can improve the company’s corporate image, in demonstrating a commitment to social responsibility and its employees’ well-being, which can lead to greater trust and loyalty both from current employees and other interested parties.