Calculation of the fair price of bare ownership

Who is the service aimed at?

Investors

If you are an investor and you would like to submit proposals for sale and purchase transactions involving bare ownership, this service will help you to calculate the fair value of the transaction with accurate data, enabling you to optimise your investment and take informed decisions.

Owners

If you have received an offer to sell the bare ownership of your property, our service will help you to check that it is fair. By using factors such as life expectancy, the appraised value and monthly income, you will be able to rest assured that the offer is suitable.

A report containing the results of actuarial calculations related to the life annuity.

You can see an example of the report here.

To obtain the results, the price is 360€ and we’ll give you 2 free uses for your next calculations

Get the fair price valuation in 3 steps

1

Fill in the details and click on the purchase button

2

Introduce the invoice and payment details

3

In a few moments you will receive your fair price valuation

Precio:

What does the fair price for bare ownership mean?

The fair price is the calculation of the conditions of the agreement. It consists of the evaluation of the owner’s right to have the use of their property and the evaluation of the lifetime annuity that they are to receive.

The two main obligations of the counterparty are: to pay the lifetime annuities agreed and respect the seller’s right of usufruct, allowing them to continue to use the property as agreed. On the death of the current owner, the counterparty acquires full control of the property.

The calculation is determined by the owner’s longevity, which is uncertain, the appraised value of the property and its market value, and the interest rate, a percentage for deducting the future annuity payments from the current value, making it possible to calculate the present-day value of the amounts that the owner will receive periodically in their lifetime.

In view of the above, our paid service aims to provide a report that enables the parties to evaluate the appropriateness of the agreement and decide if it requires improvements or adjustments so that it is a better fit for their interests.

The only variable that is subject to negotiation is the lifetime annuity amount. The others are fixed: appraisal, survival, interest rate and rental price. The higher the lifetime annuity, the higher the fair price of the agreement will be, as the buyer will be committed to a greater outlay over time. In contrast, a lower lifetime annuity will produce a lower fair price, reflecting a lesser financial commitment for the buyer.

If the fair price is significantly lower / higher than the appraisal value, the parties should consider whether the lifetime annuity amount is sufficient or whether it needs adjusting so that the agreement is fairer and more in line with the real value of the property.

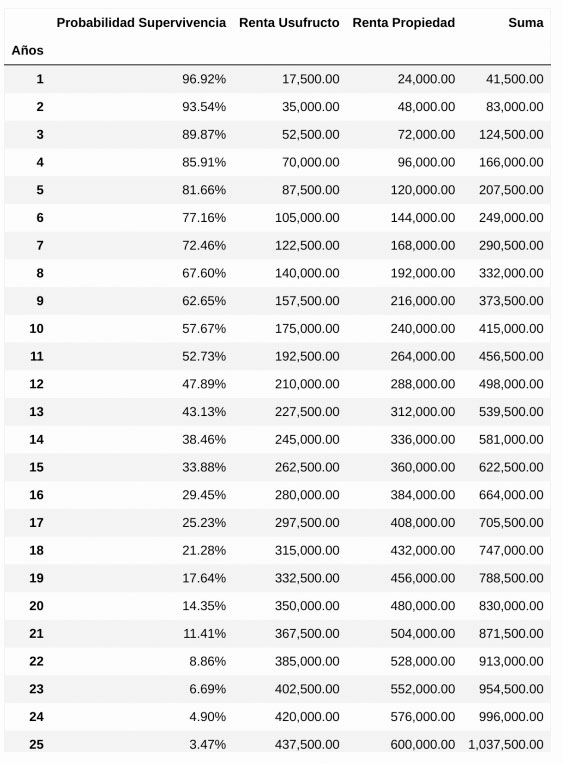

An example of a fair price valuation:

Let us imagine a person born on 05/02/1945, who is male, with a property valued at €500,000. An investor offers him a monthly lifetime annuity of monthly €2,000.

In this case, fair price valuation for the transaction is €400,867.42. This means that, during this period, he will receive a total of €231,826.94 in annuities, while the value of the usufruct to live in the property is estimated at €169,040.48.

This table shows the probability of the beneficiary surviving each year and the income they will receive if they do so, itemised under two components: the income from usufruct, which reflects the value of continuing to live in the property without paying rent, and the income from the property, which is the financial payment that they receive as lifetime annuities. Every year, the sum of these two incomes represents the total that the beneficiary will receive. As the years go by, the probability of surviving diminishes but the total value of the income increases.

What is the interest rate and the growth of income?

The interest rate represents the percentage that measures the decline in value of the money over time. In other words, today you can buy a coffee with €1 but in 20 years’ time the same coffee will cost more than €1, due to inflation.

This interest varies with each valuation and in order to minimise the risk, it is advisable to use a low interest rate, such as the 10-year government bond yield, which generally stands between 2% and 3%.

The growth of income is the percentage of annual increase that is applied to the lifetime annuity. For example, if a person receives a monthly income of €1,000 and annual growth of 1% is established, the first year they will receive €12,000, the second year €12,120, the third year €12,241.20 and so on until their death.

Life annuities can be level (without growth) or escalating. This will depend on the agreement between the parties. The calculations cover both options. This growth depends on each specific valuation, as does the interest rate.

Both factors are essential in evaluating the viability and real value of a transaction involving a lifetime annuity or bare ownership, as they determine how the amount received will evolve over time.

What are the main problems with this type of transaction?

Lack of protection for the elderly: One of the fundamental problems is the vulnerability of elderly people who, in trying to improve their financial situation, may relinquish property in exchange for a lifetime annuity without being fully aware of the real value of their assets or the implications of the contract. The lack of clear regulation has left many elderly people exposed to situations of abuse or contractual imbalance.

Economic injury and disproportion: The key problem in this case lies in the figure of ‘laesio ultra dimidium’ or contractual disproportion. In onerous contracts, such as the transfer of property in exchange for a lifetime annuity, the situation may arise where the assignor (usually an elderly person) relinquishes their property for a value that represents less than 50% of its fair price, which constitutes economic injury. The courts acknowledge that, although a lifetime annuity is an aleatory contract, it can be rescinded if there is a clear imbalance between the parties.

Uncertainty of the contract: In a lifetime annuity contract, there is an aleatory element that lies in the impossibility of knowing how long the assignor will live, which makes the total value of the compensation uncertain.

Inaccuracy in the asset valuation: In this type of contract, the valuation of the property and the usufruct (the assignor’s right of use) is a critical point. If it is not performed correctly, it may mean a significant loss for the assignor.

Lack of specific regulation: The lack of specific rules to regulate lifetime annuity contracts and protect elderly people is an increasing concern, both for the judiciary and the government. This has led to situations of abuse, which emphasises the need for regulation to avoid this type of arbitrariness.